What Is IRMAA?

What Is IRMAA?

In our Monthly Financial Jargon series, in light of the Medicare Open Enrollment Period – October 15 through December 7 – being right around the corner, we are discussing an important Medicare term to know: IRMAA.

What is IRMAA?

IRMAA is an acronym that stands for “income-related monthly adjustment amount.” IRMAA represents a supplemental amount people are required to pay if their modified adjusted gross income, known as MAGI, exceeds a certain threshold. That being said, IRMAA does not apply to everyone; it strictly applies to high-income earners and those whose income surpasses the MAGI upper limit. Additionally, it only applies to people who are enrolled in Medicare Part B and/or Medicare Part D.

How is Medicare Funded?

The Medicare program is run by a federal agency called the Centers for Medicare and Medicaid Services (CMS), which is a branch of the Department of Health and Human Services (HHS). Medicare is funded by the U.S. Treasury through two trust fund accounts that the Treasury holds: the Hospital Insurance (HI) Trust Fund and the Supplementary Medical Insurance (SMI) Trust Fund. These two funds are exclusively used to finance the Medicare program.

The HI Trust Fund is financed through Medicare payroll taxes paid by employers and employees and is supplemented by incomes taxes paid on Social Security benefits, Medicare Part A premiums from individuals who are ineligible for premium-free Part A, and interest earned on investments made in the fund. The HI Trust Fund pays for overall administration of the Medicare program and Medicare Part A benefits. The SMI Trust Fund is financed through premiums from individuals enrolled in Medicare Part B and Part D, funding commissioned by Congress, and additional sources like interest earned on the fund’s investments. The SMI Trust Fund subsidizes Medicare Part B and Part D, in addition to supplemental funding for the overall management of the Medicare program. IRMAA comes into play for the adequate financing of the SMI Trust Fund.

Origins of IRMAA

IRMAA was first enacted in 2003 through the Medicare Modernization Act under President George W. Bush, which was considered one of the most significant overhauls of the Medicare program since its inception in 1965. Among other provisions, the MMA created premium adjustments for low-income and wealthy beneficiaries, the latter referring to people who are entitled to and eligible for Medicare benefits. This increase in premiums for wealthier individuals was created to further fund the federal Medicare program and augment its financial stability. The premium adjustment for the wealthier beneficiaries was titled the income-related monthly adjustment amount, colloquially known as IRMAA. This premium adjustment enacted by the MMA originally only applied to high-income earners who were enrolled in Medicare Part B; however, in 2011, under the Affordable Care Act, President Obama expanded IRMAA to apply to high-income enrollees of Medicare Part D in addition to Medicare Part B.

IRMAA and Medicare Premiums

In terms of Medicare Part B and Part D premiums, the federal government pays about 75% of beneficiaries’ coverage. Those with larger incomes pay a larger percentage of their coverage for Part B and Part D, and this larger share is the IRMAA. If you are subject to the IRMAA, you will have to pay the IRMAA on top of the usual premium for these parts of coverage. Put simply, the IRMAA is a surcharge added to your monthly premiums for Medicare Part B and Part D, and this surcharge is based on your annual income.

How is IRMAA Calculated?

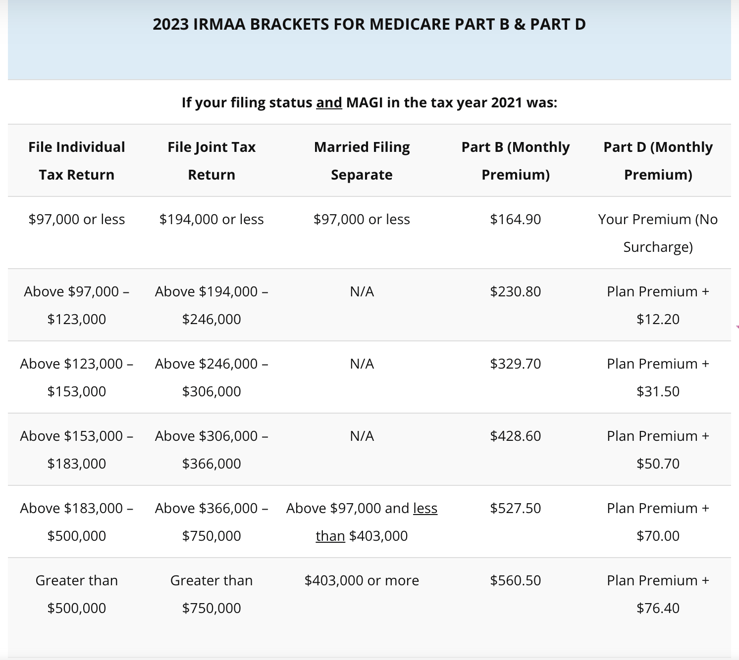

The Centers for Medicare and Medicaid Services (CMS) takes charge of calculating the Medicare Part B premiums and the IRMAA, and these amounts are listed in the Federal Register – the official journal of the federal government – every year. Part B beneficiaries typically pay around 25% of the cost for Medicare Part B. When it comes to determining whether or not you are subject to the IRMAA, the government has established five income tiers for guidance. The costs of Part B that IRMAA beneficiaries are subject to are as follows: 35% for tier one, 50% for tier two, 65% for tier three, 80% for tier four, and 85% for tier five. Note that your income level is based on your modified adjusted gross income (MAGI) from your tax fillings two years prior. This means that for 2023, your IRMAA obligation is determined based on your MAGI from 2021. The CMS also calculates IRMAA for Medicare Part D, and the surcharge for Part D is a percentage of the national base beneficiary premium for Part D in a given year. The Part D base premium for 2023 is $32.74. In the chart below, the top row lists the income maximums before IRMAA kicks in; the tier one IRMAA begins in row two, and so on. As detailed in the tiers, if you are subject to a Part B IRMAA, and if you have Part D coverage, you will also be liable for a Part D IRMAA.

Source: https://youstaywealthy.com/medicare-irmaa-brackets/ (22 August 2023).

Final Points

The Social Security Administration (SSA) assesses whether or not you owe an IRMAA based on the income you reported on your IRS tax return two years prior to the year in question. The SSA generally notifies you at the end of the current year if you will be subject to the IRMAA come January of the new year. Keep in mind that your IRMAA duties are only for one year at a time, meaning the SSA reevaluates your income and potential IRMAA responsibility for the next year at the end of every year. Additionally, each fall, your Medicare Part D plan should supply you with an Annual Notice of Change (ANOC) to inform you of any potential changes to your Part D premiums for the coming year. This notice includes changes and adjustments to your Part D IRMAA, if you are subject to the surcharge.

Monthly Financial Jargon: The world of finance and investments is notorious for its extensive use of jargon. With a goal to enhance financial literacy and make the world of money more transparent, we have our “monthly jargon” articles that focus on debunking financial terms that are often used sans explanation.

Questions and/or interested in how this applies to your financial life?

Email us here: info@afsfinancialgroup.com.

Recent Posts

Blog Archives

- December 2019 (6)

- March 2023 (6)

- November 2019 (5)

- January 2020 (5)

- March 2020 (5)

- September 2020 (5)

- January 2022 (5)

- January 2023 (5)

- August 2020 (4)

- February 2021 (4)

- March 2021 (4)

- April 2021 (4)

- November 2021 (4)

- March 2022 (4)

- April 2022 (4)

- September 2018 (3)

- February 2020 (3)

- May 2020 (3)

- June 2020 (3)

- July 2020 (3)

- October 2020 (3)

- June 2021 (3)

- May 2022 (3)

- June 2022 (3)

- August 2022 (3)

- May 2023 (3)

- June 2023 (3)

- August 2023 (3)

- November 2023 (3)

- April 2024 (3)

- December 2018 (2)

- April 2020 (2)

- November 2020 (2)

- December 2020 (2)

- May 2021 (2)

- August 2021 (2)

- September 2021 (2)

- October 2021 (2)

- February 2022 (2)

- July 2022 (2)

- October 2022 (2)

- November 2022 (2)

- February 2024 (2)

- February 2019 (1)

- March 2019 (1)

- May 2019 (1)

- July 2019 (1)

- August 2019 (1)

- September 2019 (1)

- October 2019 (1)

- January 2021 (1)

- July 2021 (1)

- December 2021 (1)

- September 2022 (1)

- December 2022 (1)

- February 2023 (1)

- April 2023 (1)

- September 2023 (1)

- October 2023 (1)

- December 2023 (1)

- January 2024 (1)

- March 2024 (1)

- May 2024 (1)

- September 2024 (1)