)%20(42).jpg)

What Is a Donor-Advised Fund (DAF)?

What Is a Donor-Advised Fund (DAF)?

What is a Donor-Advised Fund?

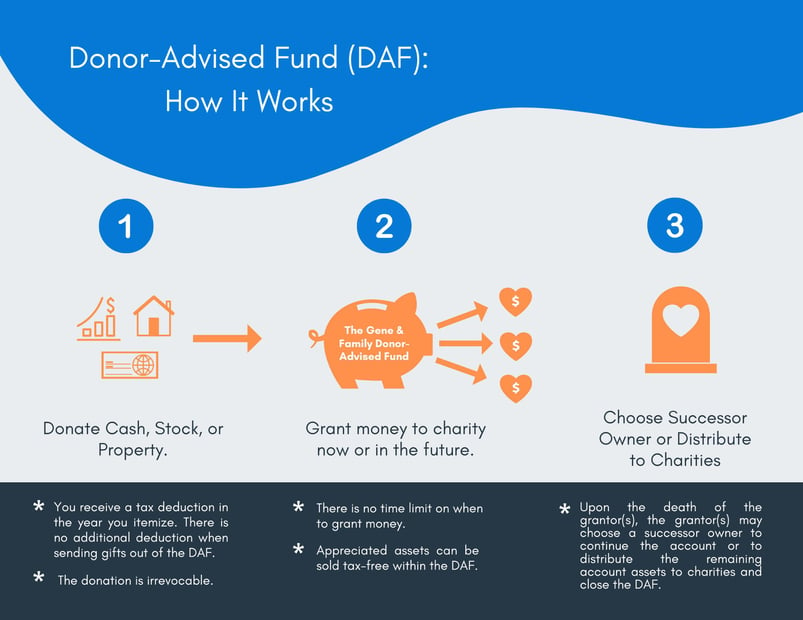

A donor-advised fund (DAF) is a charitable giving vehicle that allows you to grow and give assets to charities. A DAF is a most convenient and tax-efficient way to give back. With a DAF, you are able to contribute cash or long-term appreciated assets to the account and receive an immediate tax deduction. Assets inside of the DAF grow tax-free, and you can diversify the assets without any tax consequences. You may donate assets such as mutual funds, stock, real estate, and/or closely held business interests.

Is DAF Right for Me?

- You give to charity regularly and have appreciated assets that you would like to avoid paying capital gains on. With a DAF, instead of using after-tax dollars (check/cash/credit card), you can use appreciated assets (held for more than one year) more to get a tax deduction equal to their fair market value. This also allows you (and the charities) to avoid paying capital gains taxes.

- You would like to organize your charitable giving in one easy-to-use account. With a DAF, you have a designated account and site to do your charitable gifting from. You are able to make gifts at any time, and you can even set up recurring payments.

- You would like to build and pass on a charitable endowment. After contributions are made in a DAF, you are not required to gift from the account at any given point. This allows you to build assets within the fund to make large one-time gifts or to pass a charitable legacy on to the next generation.

- You expect to give in the future but have a high-income year where you would benefit from a large tax deduction. By leveraging a DAF, you may contribute a lump sum in a year when you expect to have a large tax liability from a bonus or business payout, for example. Doing so allows you to frontload your future donations to obtain the tax deduction in the high-tax liability year.

- You give to charity but do not itemize deductions. You may deposit a lump sum for your future gifting needs to itemize your deductions and reduce your overall tax bill.

Click here to view & download the complete Donor-Advised Fund handout.

Questions and/or interested in how this applies to your financial life?

Email us here: info@afsfinancialgroup.com.

Recent Posts

Blog Archives

- December 2019 (6)

- March 2023 (6)

- November 2019 (5)

- January 2020 (5)

- March 2020 (5)

- September 2020 (5)

- January 2022 (5)

- January 2023 (5)

- August 2020 (4)

- February 2021 (4)

- March 2021 (4)

- April 2021 (4)

- November 2021 (4)

- March 2022 (4)

- April 2022 (4)

- September 2018 (3)

- February 2020 (3)

- May 2020 (3)

- June 2020 (3)

- July 2020 (3)

- October 2020 (3)

- June 2021 (3)

- May 2022 (3)

- June 2022 (3)

- August 2022 (3)

- May 2023 (3)

- June 2023 (3)

- August 2023 (3)

- November 2023 (3)

- April 2024 (3)

- December 2018 (2)

- April 2020 (2)

- November 2020 (2)

- December 2020 (2)

- May 2021 (2)

- August 2021 (2)

- September 2021 (2)

- October 2021 (2)

- February 2022 (2)

- July 2022 (2)

- October 2022 (2)

- November 2022 (2)

- February 2024 (2)

- February 2019 (1)

- March 2019 (1)

- May 2019 (1)

- July 2019 (1)

- August 2019 (1)

- September 2019 (1)

- October 2019 (1)

- January 2021 (1)

- July 2021 (1)

- December 2021 (1)

- September 2022 (1)

- December 2022 (1)

- February 2023 (1)

- April 2023 (1)

- September 2023 (1)

- October 2023 (1)

- December 2023 (1)

- January 2024 (1)

- March 2024 (1)

- May 2024 (1)

- September 2024 (1)